november child tax credit amount

The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund. By declining the monthly advance payments of Child Tax Credit CTC parents who are eligible can claim the full 2021 Child Tax Credit up to 3600 for a child under 6 and up to 3000 for a.

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

. 150000 if married and filing a joint return or if filing as a qualifying widow or widower. Child tax credit deadline coming that could give up to 1800 per child to some families on Dec. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18.

The IRS and the Department of Treasury Treasury provided an online Non-Filer Sign-up Tool as a convenient way for people who do not ordinarily file a tax return with the IRS to claim advance CTC payments and missing stimulus payments or. The total credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17 with an income cap of 150000 for couples. 75000 if you are a single filer or are married and filing a separate return.

The full expanded child tax credit amount is 3000 for each qualifying child between ages 6 and 17 at the end of the 2021 tax year and 3600 for each qualifying child 5 and younger at the end. The next child tax credit check goes out Monday November 15. Families who utilized the six monthly advance payments can expect to receive 1800 for each child age 5 and younger and 1500 for each child between the ages of 6 and 17 on their 2021 tax return.

Enter your information on Schedule 8812 Form 1040. Instead of calling it may be faster to check the. The credit was made fully refundable.

Get your advance payments total and number of qualifying children in your online account. Under the American Rescue Plan families can choose to receive monthly payments in place of an annual lump sum. 2 If the value of the credit exceeds the amount of tax a family owes the family may be eligible to receive a.

The child tax credit allows taxpayers to reduce their federal income tax liability the income taxes owed before tax credits are applied by up to 2000 per qualifying child. IRS just sent out another 500 million to Americans. The stimulus check part of President Joe Bidens child tax credit plan will see those who meet the final November 15 deadline potentially receive.

Missing Advance Child Tax Credit Payment. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. The credit amount was increased for 2021.

The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund. Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their. NOVEMBERs child tax credit cash will be sent out to parents in need across the country next week.

The child tax credit was expanded for one year under the American Rescue Plan Act of 2021 ARPThe ARP increased the credit to 3600 per child under the age of 6 and 3000 per child between the ages of 6 and 17 note also that it increased the maximum age for. Specifically the Child Tax Credit was revised in the following ways for 2021. That means theres limited.

Thank you for visiting our web page about economic impact payments EIP the Child Tax Credit CTC and other refundable tax credits. 112500 if filing as head of household. The penultimate round of Child Tax Credit payments from the American Rescue Plan will begin landing in bank accounts on Monday 15 November and some households could receive a larger-than-expected.

This reconciliation will be reported on your 2021 individual tax return. To reconcile advance payments on your 2021 return. This change will help families cover real-time.

The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. The expanded tax credit delivers monthly payments of 300 for each eligible child under 6 and 250 for each child between 6 to 17 years old.

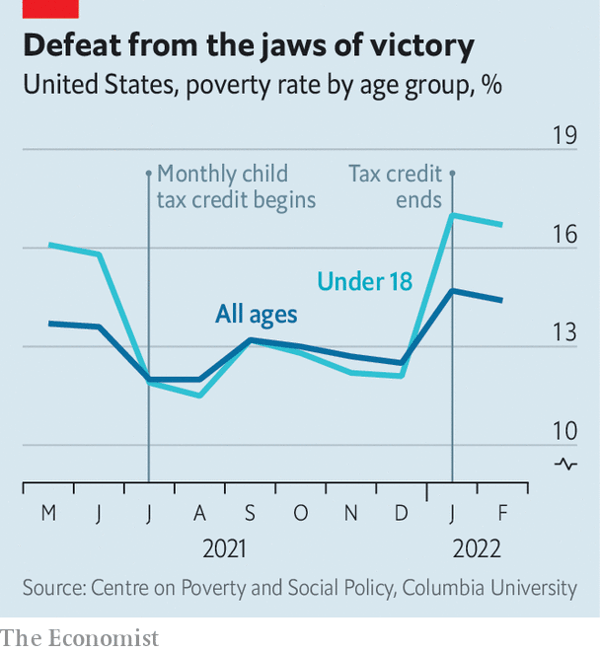

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Expanded Child Tax Credits Expected to Lift 4 million US Children Out of Poverty. Heres whos getting it.

Very soon if you received advance payments of the Child Tax Credit you will be required to reconcile the payments received between July and December with the total amount of credit you are eligible for in the 2021 tax year. This week the IRS began issuing the first-ever monthly installments of the expanded Child Tax Credit.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit Advanced Payment Option Tas

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit 2021 8 Things You Need To Know District Capital

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Face Finances On Instagram Just A Quick Tip There S A Difference Between A Tax Credit And A Tax Deduction Some Exampl In 2022 Tax Deductions Income Tax Tax Credits

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit Schedule 8812 H R Block

The Child Tax Credit Toolkit The White House

Child Tax Credit Will There Be Another Check In April 2022 Marca

Pin On Family Economic Security

2021 Child Tax Credit What It Is How Much Who Qualifies Ally